[ad_1]

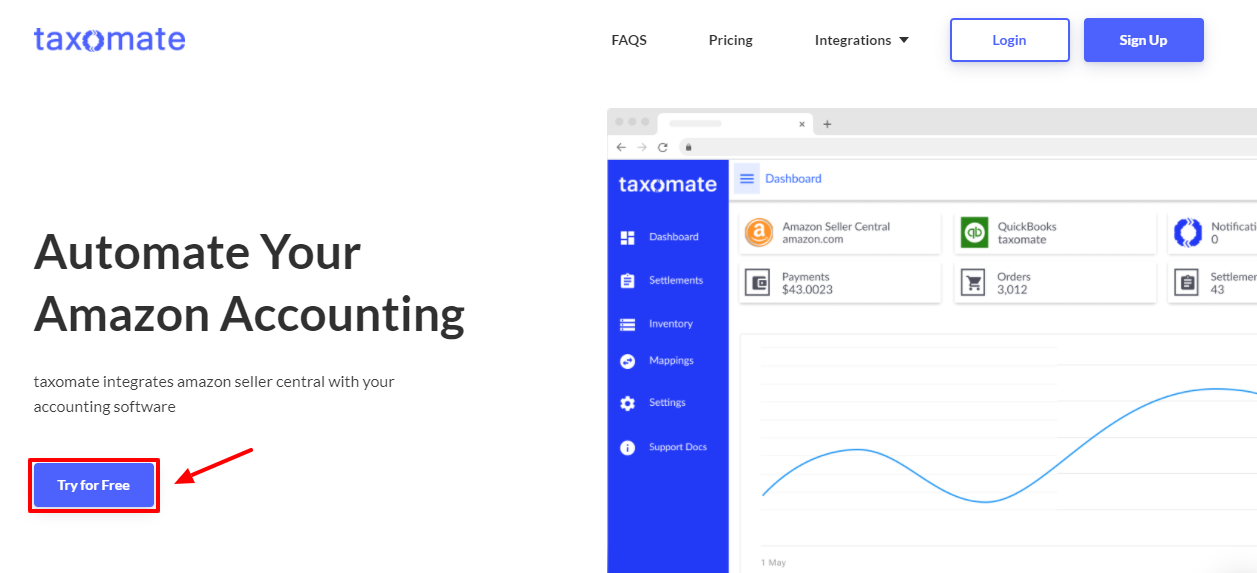

Can’t find an affordable solution to automate your accounting and sales tax? Then I present you with Taxomate Review. It is the best “Paid service” with “amazon accounting integration software” you can find. Are you tired of manually importing your transactions from your Amazon Seller Account to QuickBooks Online or Xero Accounting? Taxomate is created to allow Amazon sellers to easily import existing orders to Xero accounting or QuickBooks online.

In this article, I will talk about how Taxomate works, its main features, pricing plans, and pros and cons. These tips will actually help streamline your accounting processes and save you money.

Whether you have already known about Taxomate or if it’s your first time hearing its name. Then, this is your go-to-guide for all the things related to pricing and features of Taxomate.

Through this article, you will learn that Taxomate is a paid service that automates your Amazon accounting. Taxomate is 50%+ cheaper and it is easy to use and it is recommended by hundreds of sellers Taxomate works with QuickBooks Online, Wave, and Xero Accounting. It doesn’t work with QuickBooks desktop at the moment

About TaxomateReview: In A Nutshell

The problem with bookkeeping for Amazon traditional bookkeeping software like QuickBooks, Wave, and Xero doesn’t integrate very easily. Traditionally businesses make an invoice and send it to the customer to review and pay Amazon sells your items and takes various fees.

Accounting for only the net Amazon payment is not correct since you don’t report the true gross sales amount and separately all the Amazon fees. Additionally, sellers often get payouts every two weeks. Taxomate claims to automate this process and your Amazon accounting.

Overall Taxomate is easy to set up and has multi-currency support. It also works with many country marketplaces and is very fairly priced. It supports the cost of goods sold, allows you to import your entire sales history, and allows unlimited accounts and teammates – all at no extra cost. The pricing is based on the number of orders. It doesn’t work on QuickBooks desktop or employed. You can also try some alternatives of Taxomate like Helium 10.

Taxomate Review: How It Works

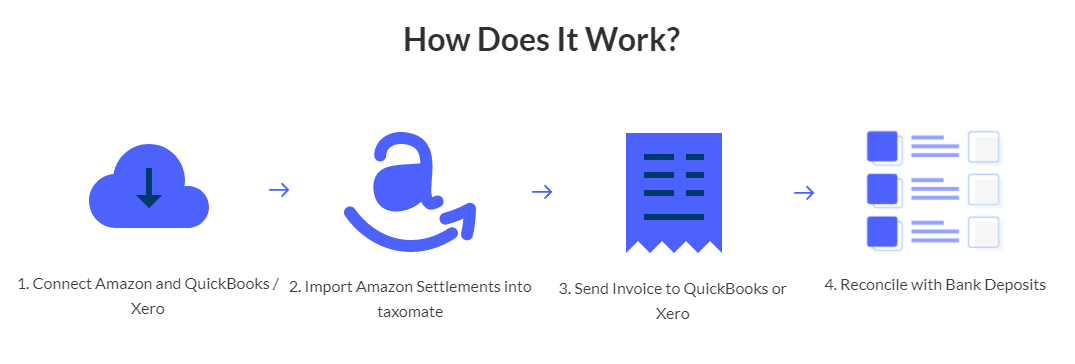

Taxomate allows you to transfer all of your Amazon settlements in seller central to QuickBooks, Wave, or Xero, so whether you’re a US seller looking to properly assess your Amazon income in expenses or a European seller looking to understand your liability, this software will meet your needs. Settlement can be sent as invoice or journal entries to your accounting software to be reconciled with payment Amazon sent to your bank account.

Taxomate also allows you to calculate your cost of goods sold for a settlement period to send over to QuickBooks or Xero. After registering and confirming your email you will be shown the quick set up page to get your account up and running. First, you’re going to connect all of your Amazon marketplace accounts. Taxomate does not put any restrictions on how many accounts you can connect. Next, you can connect your accounting software whether to QuickBooks Online, Wave, or Xero accounting.

After you set up your mappings for your Amazon marketplaces taxomate breaks Amazon transaction types into different groups which allow us to break out income expenses and more for proper Bookkeeping. You also use recommended mappings or custom accounts from your current chart of accounts from QuickBooks, Wave, or Xero. You can use the same accounts for each marketplace or choose separate accounts. Mappings can always be changed after the quick setup is complete.

In the final step, select the bank account attached to QuickBooks, Wave, or Xero where you receive Amazon payments and pay Amazon fees. For most Amazon sellers quick setup should be enough. However further customizations and changes can always be made later on. Once you are finished with a quick set up you will be taken to your dashboard. You will likely not see any settlement yet since it usually takes a bit of time to import from Amazon.

What Does Taxomate Have to Offer?

Now that you’ve learned about Taxomate and how to use it, let’s delve deep into the features that Taxomate provides. After reading this you will hopefully realize why Amazon sellers love Taxomate and how it can help your Amazon sales reach new heights. Be it automation, taxation, or affordability, Taxomate has an answer for all your troubles!

-

Automate Your Accounting Using Taxomate

One mistake I’ve noticed among Amazon sellers is their defiance when it comes to bookkeeping. They may differ in size or scale, but they’re always adamant about managing their accounts on their own. They may not be confident about their bookkeeping skills. Some hate bookkeeping while others are scared of their data getting into the wrong hands.

I have only one message for these sellers, you’re wasting your time! Why enter each transaction manually when you can automate the whole thing using a tool like Taxomate and keep a very precise record while saving precious time. Taxomate can collect and process data from the Amazon Marketplace automatically for your perusal. You can then integrate your accounting solution to Taxomate to transfer all this data for easy reconciliation. I will explain this topic in detail below.

-

Integrate Taxomate With Your Accounting Software

Tired of burning the midnight oil to reconcile your Amazon deposits with your accounts? Well, Taxomate is here to save the day!

Every time you perform a transaction on Amazon, Taxomate captures it. Then, you can easily import all your transactions from Taxomate into your accounting software. Currently, Taxomate allows integrations to Quickbooks, Xero, and Wave. After you connect your accounting software, reconciling data from the Amazon Marketplace and your accounting software will become a cake-walk as Taxomate’s invoices

You can also shift from one Accounting solution to another at any time.

-

Support for All Major Markets

A wide variety of software solutions may be available to Amazon sellers today to automate their accounts. But what happens when these solutions lack support for your location?

Taxomate is one of the few solutions that offer its services to a vast number of markets. Presently, Taxomate offers 100% support to sellers in North America, Japan, and Oceania and the major markets in Europe. It also provides beta access to sellers in Asia and Europe.

Tax season is a scary nightmare for most up-and-coming Amazon sellers. I have seen numerous sellers come close to having a nervous break-down due to the complicated nature of tax laws across the globe. You can’t blame them!. Their fears have a lot to do with the way the Amazon Marketplace and how their FBA systems work.

Many sellers constantly pay hefty fines due to mistakes that can be easily avoided. This is where Taxomate comes to your aid. Taxomate can import data from Amazon which can then be fed into Quickbooks or the software of your choice to make tax payments easy and stress-free!

-

Dealing with Income Tax and the IRS

Taxomate has solutions for all your Income Tax needs too. A notice from the IRS is usually enough for a panic-induced heart attack but if you use Taxomate, these fears are unnecessary!

After integrating Taxomate with Quickbooks, you can easily enter the mapped data from Quickbooks to Turbotax. Turbotax is an online tax solution that can automatically match the data from Quickbooks with your 1099s in a snap. Turbotax is extremely secure and affordable. They guarantee 100% accuracy when it comes to filing tax returns. It also offers plenty of support if you’re new to this.

Importing data from Quickbooks to Turbotax is possible, but without Taxomate, you’ll have to spend hours entering all your data manually into QuickBooks.

-

Automatically Calculate COGS

Cost of Goods Sold (COGS) as the name suggests, is the total cost of all the goods you were able to sell in a given period. Taxomate can not only calculate your COGS automatically but also include data from the Adjustments Report on Amazon to account for transfers and losses due to damaged goods.

It’s worth noting that Taxomate calculates COGS using the Average Cost Method.

-

Multiple Import Options for Your Convenience

Worried about importing older data from Amazon into Taxomate? Don’t worry, Taxomate has you covered. You can import every single Flat File you have. Taxomate even supports Version 1s so if you can have your entire selling history on Taxomate if that’s what you want.

-

1:1 Support for All Your Needs!

Taxomate provides 1:1 onboarding to help you set up your account with Amazon and your accounting software. It’s available anytime, even a year after you opened your account, at no extra charge.

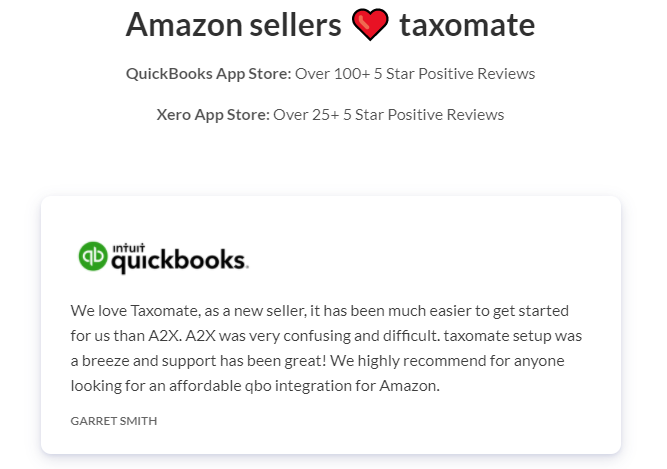

Taxomate Customer Reviews

Taxomate has great customer reviews. According to various users, it is the best A2X alternative. It serves great value for the money. If anyone is searching for an alternative to A2X then taxomate is the best choice. They offer fast and manageable importing settlement services.

Many claims that it keeps adding new features with time. Their customers’ help services are quick and very helpful. Taxomate has removed many of the problems regarding Amazon accounting and has proved beneficial to many clients. People who are using taxomate love the way by which it evaluates the COGS and provides easy reconciliation with Amazon payments.

Many customers of taxomate have responded in a very positive and thankful manner. They say that they are very open to any suggestions for improvement. Other apps they use for Amazon FBA and accounting work seem very expensive and not as good as they claim. They provide you with all the useful features like COGS, integration, multiple accounts, etc.

So overall, we can say taxomate knows what its users need and has many happy customers.

Performance Of Taxomate

Taxomate is unlike any other tool currently available in the market. It has a unique look and feels from an aesthetic standpoint but beyond that, it is also functionally superior to any other alternative (similar tool or service) available in the market today. Taxomate allows its users to have a hassle-free sales management experience as it automatically creates invoices for all Amazon sales and transactions.

Taxomate as a tool is the ultimate productivity booster as it allows business owners to spend less time and resources on managing accounts while also compiling all the transactions at the end of the financial year for tax purposes. It is also a huge plus point in the favour of Taxomate that it has native integration with Amazon and QuickBooks which allows for seamless interaction between your Amazon account and Taxomate.

One of the biggest advantages Taxomate has over its competition is its affordable pricing and its user-friendly customer service which is available 24/7. Taxomate is considerably more beginner-friendly than services like A2X which is the second-best accounting tool available to Amazon sellers.

Taxomate’s 1:1 customer service is available to its users through multiple mediums such as voice chat and video call. This gives any new user immense confidence in Taxomate’s service as they are assured help is just one call away. Thousands of satisfied customers and awesome customer reviews are testaments to the success of Taxomate’s performance as the first choice for amazon sellers.

Ease of Use and Customer Support

If you are a seller on Amazon and you are finding it hard to compile all your daily transactions, calculate your profit amount, and calculate your Tax amount then Taxomate is what you’re looking for. Taxomate solves all kinds of accounting problems for every Amazon seller and compiles all date to day transactions, calculates the profit, and gives all the Taxation details. Taxomate allows its users to get all the transactional history from Amazon.

Taxomate gives each and every customer special treatment and addresses each and every question with complete attention through one on one video chat It provides complete support and attention to each and every customer and provides complete customer care.

Taxomate also provides separate calculations for product sales, advertising cost, shipping cost, etc. It removes any kind of confusion during the final calculations and provides accurate results with complete transparency. It compiles all the transactions in one invoice which helps any user to match the final Amazon payment. With all these facilities and 24/7 customer support, Taxomate also comes at very affordable pricing for all its users. Taxomate is the solution for all your accounting problems.

Security

Taxomate also provides complete security to all the user’s personal and business data. Taxomate uses modern technology and encryption to secure the privacy of all its users. Taxomate provides complete transparency to all its users about each third-party vendor it users in its privacy policy.

Usually, such apps that come in an affordable price range or for free compromise the privacy of all the users but taxomate take no chances when it comes to providing complete and top security to all its users. Taxomate provides to all its customers 24/7 helpline call services which will help you in solving any kind of doubt you are having regarding your privacy and security.

Pricing: How Much Does Taxomate Cost?

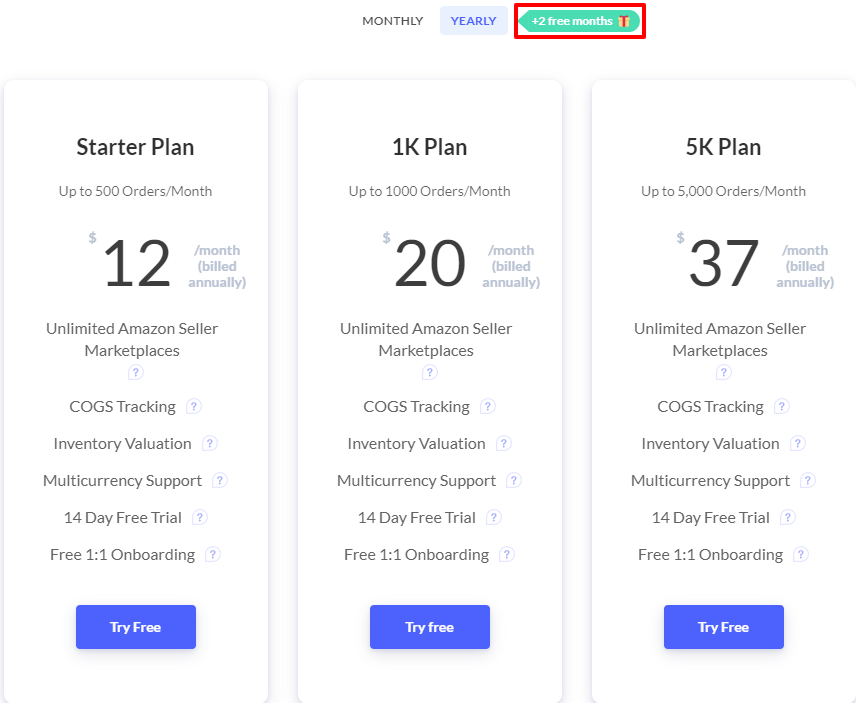

Taxomate has a number of affordable plans. They offer various packages and also give you a free trial.

- The pricing is based on the average amount of orders per month.

Everyone plan comes with the ability to add an unlimited amount of Amazon seller accounts. Taxomate can support any order amounts, but here are examples:

- Up to 500 Orders / Month – $12 per month (billed annually)

- Up to 1,000 Orders / Month – $20 per month (billed annually)

- Up to 5,000 Orders / Month – $37 per month (billed annually)

- Up to 10,000 Orders / Month – $66 per month (billed annually)

Taxomate Pros and Cons

FAQs On Taxomate Review

✌Does Taxomate support QuickBooks Self-Employed?

Taxomate uses an API (Application Programming Interface) to communicate with QuickBooks and similar apps. As of now, Inuit (the company behind QuickBooks) has not made an API available for QuickBooks Self-Employed. Taxomate will support QuickBooks Self-Employed once this API is made public.

👉 Can Taxomate export all the details of my Amazon Loan transactions?

All funds received and payments made towards your Amazon Loan account will be present in Taxomate’s records. But specific details of these transactions, ie. bifurcation of interest and principal paid is not available at the moment. You’ll have to make this entry manually in your accounting software.

🔥 I tried to import my settlements from Amazon Central but none were imported. What can I do?

The settlement file you downloaded may be corrupt. If your account is in V1 format, I’d recommend you to convert to a V2 account. To do this, simply email Amazon support requesting them to convert your account to a V2 account. If your problem persists, contact Taxomate support.

Quick Links:

Conclusion: Taxomate Review 2022

When I first heard of Taxomate, I thought it was just another run-in-the-mill accounting solution that over-promises but under-delivers. But Taxomate surprised me. Its wide array of features and unique UI made me feel right at home. Their support services and documentation were very helpful.

So for the million-dollar question, Is Taxomate worth the price?

Yes! The amount of time and money Taxomate will save you can surely outweigh their monthly subscription fee. After using Taxomate, you won’t be able to go without it.

But some features are still missing in Taxomate. Currently, they allow integration only for QuickBooks Online, which can be an issue for those wishing to use it with QuickBooks Desktop. Only the beta version of Taxomate is available in many emerging markets. Also, mapping can be a hassle for beginners and takes some time to get used to.

If you’re an Amazon seller intent on handling your books by yourself or want to pay your e-commerce accountant less in preparing your books, Taxomate can become your best friend in no time.

[ad_2]